Blockchain has changed the world of online payments drastically. The only thing that is probably similar between crypto and traditional payments is commission.

Understanding the costs and benefits of fees and commissions is essential for anybody working with blockchain technology, especially as the value of crypto assets continues to rise. This article will go through the various blockchain fee structures, their functions, and how various blockchains make use of fees.

Key Takeaways

- Blockchain fees are commissions paid to the network for actions on the blockchain.

- Cryptos have transaction and gas fees.

- Gas fees are a subgroup of transaction fees specific to blockchains that use smart contracts.

- Different blockchains have different fee policies.

What Is Blockchain Fees

Transactions on the blockchain incur blockchain fees, which are charges paid to the network. Because of the network’s “demand-driven” pricing structure skyrockets when the system is actively used.

Transaction fees (or trading fees) and gas fees are the most prevalent types of blockchain-related costs.

A cost is associated with transferring a particular number of crypto assets from one wallet to another. The transaction cost might go up or down depending on how active the blockchain is. A user might opt to pay a greater transaction fee to have their transaction processed more quickly.

Transaction and contract execution on the Ethereum blockchain require the payment of gas costs. These costs reflect the time and energy used by computers in processing these communications.

Blockchain fees vary from digital asset to digital asset, ledger to ledger, and transaction volume to transaction volume. Typically, the native coin of the blockchain is used to pay the transaction fee. For instance, Ethereum’s gas fees are set in ETH.

Also, the fee amount depends on the action you are trying to perform on the blockchain. Thus, simple and small operations are charged with small fees, while complicated actions require larger commissions.

Initially, blockchain payments were free of charge since the waiting time for confirmation did not exceed 25 minutes. But with the growing popularity of digital currencies, the number of payments has increased, and the commission has become mandatory.

Commissions in the blockchain are mandatory and perform two important functions:

- Support miners and validators that help register the payment process and confirm transactions in the ledger. When processing payments, miners select transactions with the best amount-to-fee ratio to increase their profits.

- Ensure the security of the network, protecting it against spam attacks. It works as a tool against hackers trying to attack the network by initiating a large number of operations simultaneously: typically, it is too expensive for attackers to start thousands of transfers with a commission.

In addition, fees regulate the sequence of crypto transactions around the world: the larger the fee, the faster the transfer is processed and confirmed.

How Are Transactions Made In Blockchain?

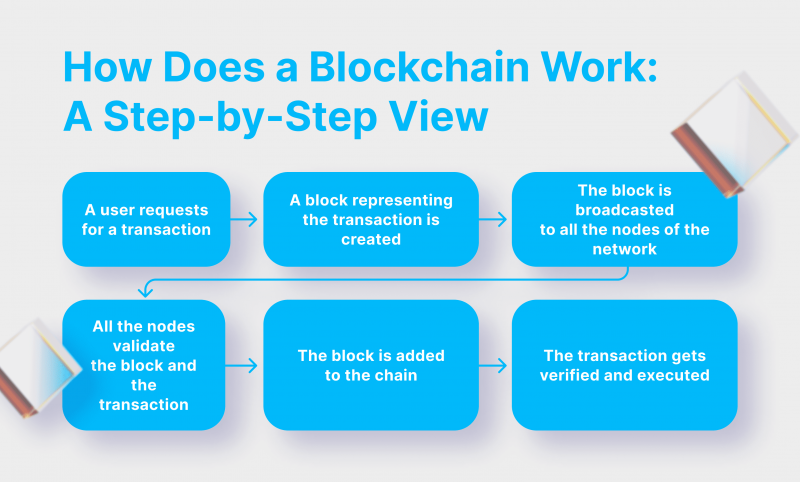

Though transactions in the ledger are performed relatively fast, complex processes are going on off-screen:

- After a user initiates the transaction, the blockchain system checks if the user has enough cryptocurrency to finish the operation.

- Next, the transaction is broadcasted to all P2P computers in the selected network called nodes.

- After this, the transaction goes to a mempool, where it waits for the miner to process it and include it in the block in the pending status. Miners are users who have special computer programs that register and confirm transactions in the blockchain with the help of complex mathematical algorithms. Miners receive compensation for the computing energy required to process and validate transactions in the form of the gas paid by the initiator.

- A miner checks the transaction against validation rules specific to the selected blockchain, verifies the transaction, and includes it in the block.

- A new block is added to the existing blockchain and becomes a part of this blockchain.

- After the transaction is complete and part of the blockchain, it cannot be altered.

The priority of a transaction’s processing is evaluated by the fee amount: the higher the blockchain fee, the faster the transaction is processed.

All transactions in the ledger are unidentified, so it is impossible to monitor users’ actions, but the method for queuing, sorting, and verifying transactions is open and transparent. On websites like Blockchair or Etherscan, you can monitor the workload of the blockchain network in real-time, view transactions in a particular block, explore the average commission and calculate the commission to specify for the transfer so that a miner prioritises your transaction.

How Are Blockchain Fees Calculated?

Transaction commissions in the blockchain can be compared to traditional payment methods, like credit cards or PayPal: every time you transfer digital assets, you pay a fee. However, digital currency transaction fees go to the node operators that secure the network instead of going to a centralised entity. These crypto transaction fees help encourage more people to either mine a PoW coin like Bitcoin (BTC) or stake their crypto on a PoS chain like ETH since the more nodes a cryptocurrency has, the more decentralised it becomes.

Gas fees are a subgroup of transaction commissions specific to blockchains that use smart contracts. Though Ethereum was the first blockchain to introduce gas fees, today, many competing blockchains like Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) charge gas fees to use their networks. These fees go directly to a blockchain’s validators as compensation for the energy they use to secure the net.

Unlike standard transaction fees, you must pay gas fees with your blockchain’s native cryptocurrency. For example, all crypto gas on Ethereum is paid in ether, while gas commissions on Solana are charged in SOL tokens.

Gas fees apply to all contract blockchains.

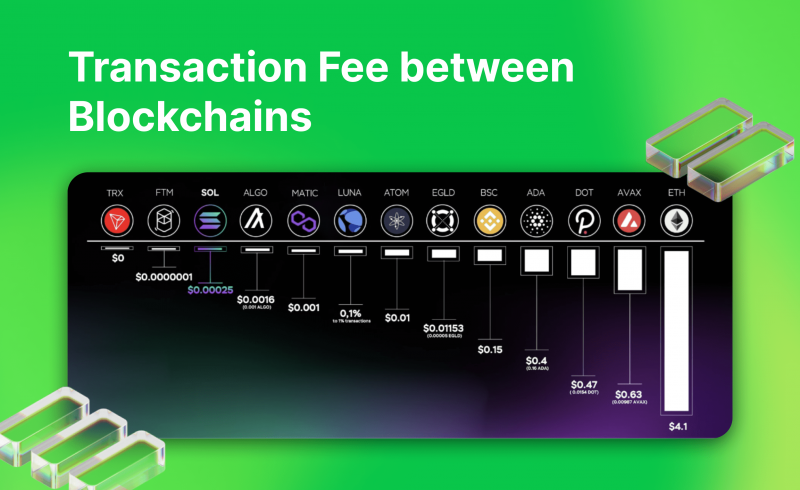

As we mentioned above, the fees depend on the blockchain. Let’s look at the most popular blockchains and their fees policy.

Bitcoin

BTC is the most widespread cryptocurrency in the world and the world’s first blockchain technology network. So, it sets the standard for transaction fees many cryptocurrencies use today.

BTC miners receive a fee for verifying transactions and placing them in new blocks. Users agreed to pay greater fees when transferring their BTC since miners prioritise the transactions with higher fees.

BTC transaction fee serves as a spam filter since those who want to slow down the net must pay a commission for each transaction. If the BTC network fee is too low, miners will ignore such transactions; however, if the fee is significant, attackers incur a high economic cost.

A user must pay a commission to the miner for their transaction to be placed in the blockchain. Due to the limited space in each block, the more a user spends, the more likely their transaction will be processed immediately.

Two factors determine Bitcoin transaction fees:

- The size of a transaction, that is, the transaction data volume. The quantity of transactions that can be processed in one block is limited, meaning larger transactions require more data and pay higher fees.

- Users’ demand for block space. The higher the fee a user pays, the faster their transaction is validated by a miner.

Ethereum

ETH is a smart contract platform that enables developers to build dApps in their blockchain.

Gas fees on the ETH ledger can vary and are measured in ETH, the network’s native token.

ETH fees depend on the network traffic, meaning miners will likely prioritise your transaction if you pay a higher gas fee.

Simply put, the total gas fee is the cost of your transaction handling plus a reward. However, the gas limit, which specifies the maximum price to be paid for that transaction, should also be considered.

The total ETH fee is defined by the relation between the gas cost, which represents the whole amount of work, and the gas price, which is the price paid for each hour of work.

Gas costs are anticipated to decline as ETH moves closer to a PoS mechanism. The network will require less processing power to verify transactions, reducing the volume of gas required to confirm a transaction. Although validators prioritise higher-paying transactions, network traffic might still impact transaction costs.

Tron

Tron is a decentralised blockchain platform that is compatible with ETH smart contracts. It aims to provide a smart-contract operating system that supports scalable, quick, and inexpensive transactions. Like many other blockchains, Tron has its native token TRX.

The TRON network is based on resource units — energy and bandwidth.

Bandwidth is necessary to transfer assets in the network, and energy points are needed for smart contract fees.

Tron fees are calculated based on energy, bandwidth, and transaction type.

- Usual transactions cost bandwidth points. Users receive a certain amount of free bandwidth points daily, or if the provided amount is insufficient, they can freeze their TRX to gain more (TRX are distributed straight from the sender account). Required TRX amount is calculated as the number of bytes * 10 SUN, where 1 TRX equals 1,000,000 SUN.

- Smart contracts are paid by the energy that can only be obtained by staking TRX; no free daily points are provided.

Compared to other networks and cryptocurrencies, standard TRX transactions have lower fees. Depending on the total bandwidth, Tron smart contracts may have higher costs.

Binance Smart Chain

Binance Smart Chain (or BSC) is part of the Binance ecosystem. It was designed to enable developers to create dApps and allow users to manage their digital assets between varying blockchains. The platform uses the PoS consensus model and is compatible with the Ethereum network.

BNB is the native token of the Binance ecosystem and can be used in BS. BNB is mainly used to pay commissions on the Binance exchange, staking, and asset transfers; however, it can handle BSC smart contracts.

The BSC fee structure is very similar to that of ETH. The transaction commissions are denoted in Gwei — a smaller unit of the token equal to 0.000000001 BNB. Users can set their gas prices to prioritise their transactions added to the block.

To find out the current and historical average of BNB network fee users, go to BscScan.

The BSC fees are commonly very low, but you always have to have some amount of BNB in your account to send tokens since the fees are paid in BSC’s native token.

Solana

A blockchain platform called Solana is intended to run scalable, decentralised apps. Compared to competing blockchains like Ethereum, Solana processes transactions substantially quicker and charges significantly cheaper commissions. In fact, Solana’s gas paid with SOL — Solana’s native token — is considered some of the lowest in the industry.

Since its launch, Solana has maintained a consistent policy on transaction commissions, with gas commissions per transaction of 0.000005 SOL. However, an additional fee was established to prioritise specific transactions in return for a higher fee.

A regular Solana gas fee is one of the cheapest in the market thanks to the Proof-of-History (PoH) consensus mechanism. It is the cost of transactions in the Solana network.

The additional Solana gas fee (also called the priority fee) is an optional fee that enables users to speed up their transaction execution time against other users. According to Solana’s documentation, the prioritisation commission is calculated by multiplying the requested maximum compute units by the compute-unit price rounded up to the nearest Lamport, where one Lamport equals 0.000000001 SOL.

Polygon

Alongside the ETH blockchain, Polygon is a sidechain scaling solution that enables quick transactions at minimal costs.

Polygone network has its native cryptocurrency — MATIC. Commission to the network is paid in MATIC.

On the Polygon PoS network, a polygon gas fee consists of the base fee and the inclusion fee.

The base fee is burned, while the inclusion fee, sometimes known as a tip, is a payment made to network validators. Both of these fees are impacted by the market, which means that when the network is busy, the price increases. The complexity of a transaction affects its overall cost as well.

The computational effort, quantified in “gas” units, determines transaction complexity. Thus, one of the simplest transactions is transferring MATIC from one wallet to another.

Total fees are calculated as gas units multiplied by the base fee and tip sum.

Avalanche

Avalanche (AVAX) and its native token AVAX is a platform based on blockchain technology that can compete with ETH. Like ETH, Avalanche blockchain uses smart contracts to support various blockchain projects.

The fees on Avalanche are dynamic, meaning that they fluctuate depending on the demand of the network.

Transactions on the Avalanche network are quantified by computational effort, expressed in “gas” units. Simple transactions, like transferring money between wallets, take less AVAX gas than more complex ones, including interacting with one or more smart contracts.

The fee is paid in AVAX and subsequently burned.

An algorithm on the Avalanche C-Chain defines the base fee for a transaction. When network utilisation exceeds the target utilisation, the base fee rises; and vice versa; when it falls below the target, the base fee falls. The base fee has no maximum value, but its minimum amount is 25 nAVAX (1 nAVAX equals 0.000000001 AVAX).

Arbitrum

For the ETH mainnet, Arbitrum is a layer 2 (L2) solution designed to reduce network congestion and high gas. The Ethereum ledger offloads a large portion of its computing and data storage to the Arbitrum blockchain via a two-layer architecture.

Gas fees on the Arbitrum blockchain can be paid using different tokens, including ETH and Arbitrum native toker ARB.

Users pay Arbitrum gas fees to cover the cost of operating the L1 calldata and L2 resources.

L1 resources are ETH calldata, while the L2 resources are computations your transaction does in Arbitrum’s virtual machine, such as execution, writing to storage, etc. This value is the L2 gas price multiplied by ArbGas — Arbitrum’s base computation unit volume. The total L2 fee a transaction needs to pay to succeed is the sum of these two components.

Gas on Arbitrum is less than those on ETH mainnet.

Conclusion

Gas fees and transaction commissions are essential for blockchains operation. However, they can cause trouble to traders and ordinary users since sometimes it’s too challenging to calculate them, or the fee is too high. Before making a transaction, study the selected blockchain’s fee policy or use a gas fee calculator to make an informed decision.

FAQs

What Impacts The Amount Of Blockchain Fee?

The factors that influence the blockchain fees depend on the ledger. The amount of transaction volume, ledger congestion, and the user’s intention to put their transaction processing first may impact the fee amount. Thus, the larger the fee, the faster the transaction is processed. It will also be processed quicker if the network is not busy and there is no queue of transactions waiting to be verified.

Why Do We Need To Pay Gas?

Gas fees protect blockchains against spam attacks and keep the procedure of transaction validation organised. Moreover, gas fees are rewards for miners validating transactions.